By Zander Mukanos

Bored of Stocks?

Try Buying a Basquiat!

An investment made into the S&P 500 cannot hang on your wall, but a $7 million painting from world-renowned American artist Ed Ruscha can. Why watch your money become another line on a routine monthly statement when it can blossom into priceless art?

Investing in traditional stocks has proven to be a consistent and relatively safe way to manage and grow your existing money. Whether through a stock brokerage or acting as a retail investor, 61% of Americans report that they own some type of stock, according to Gallup Research. There is no singular “best way” to invest your money, but investors should look to art as a new way to enjoy their investments while simultaneously watching them grow over time.

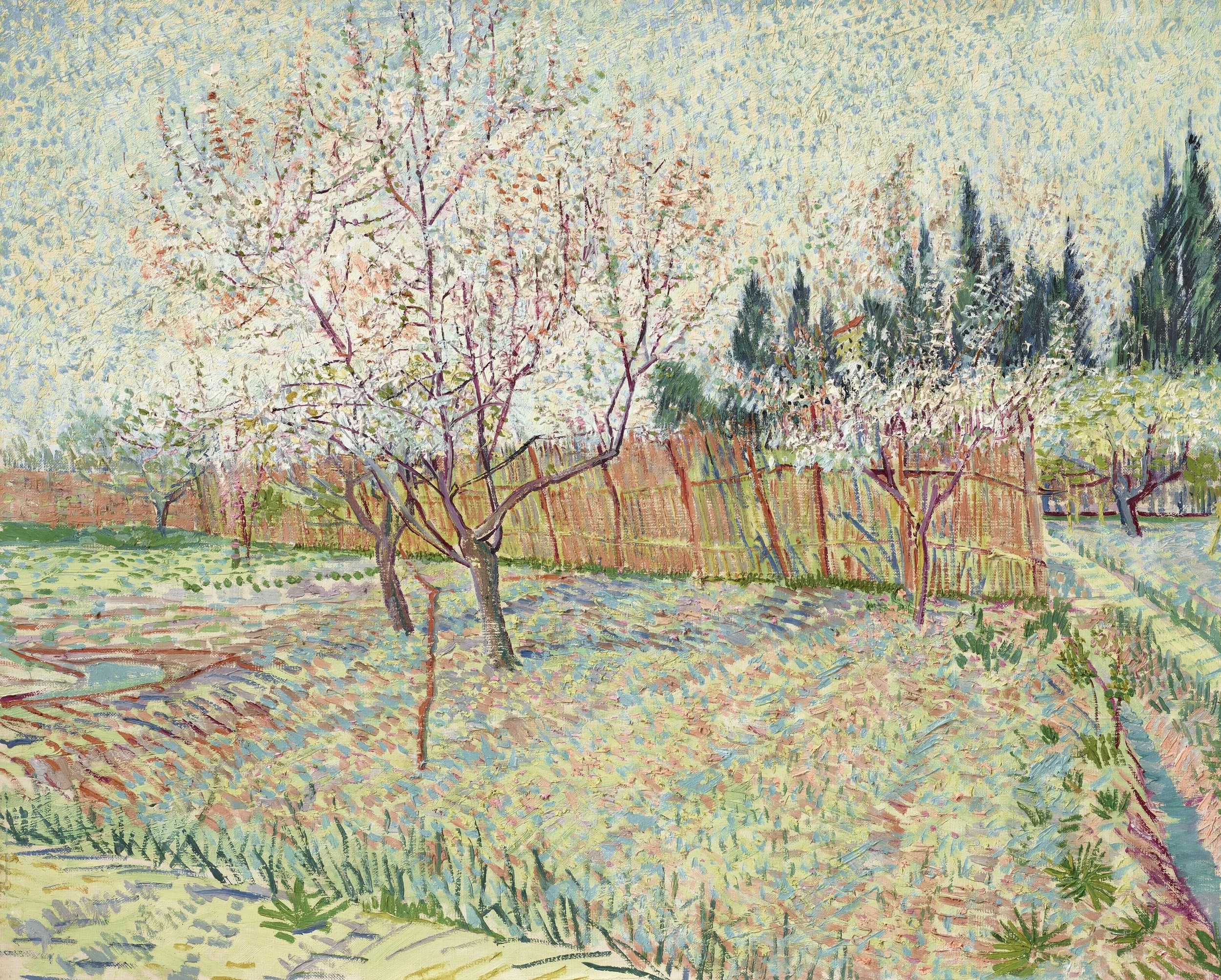

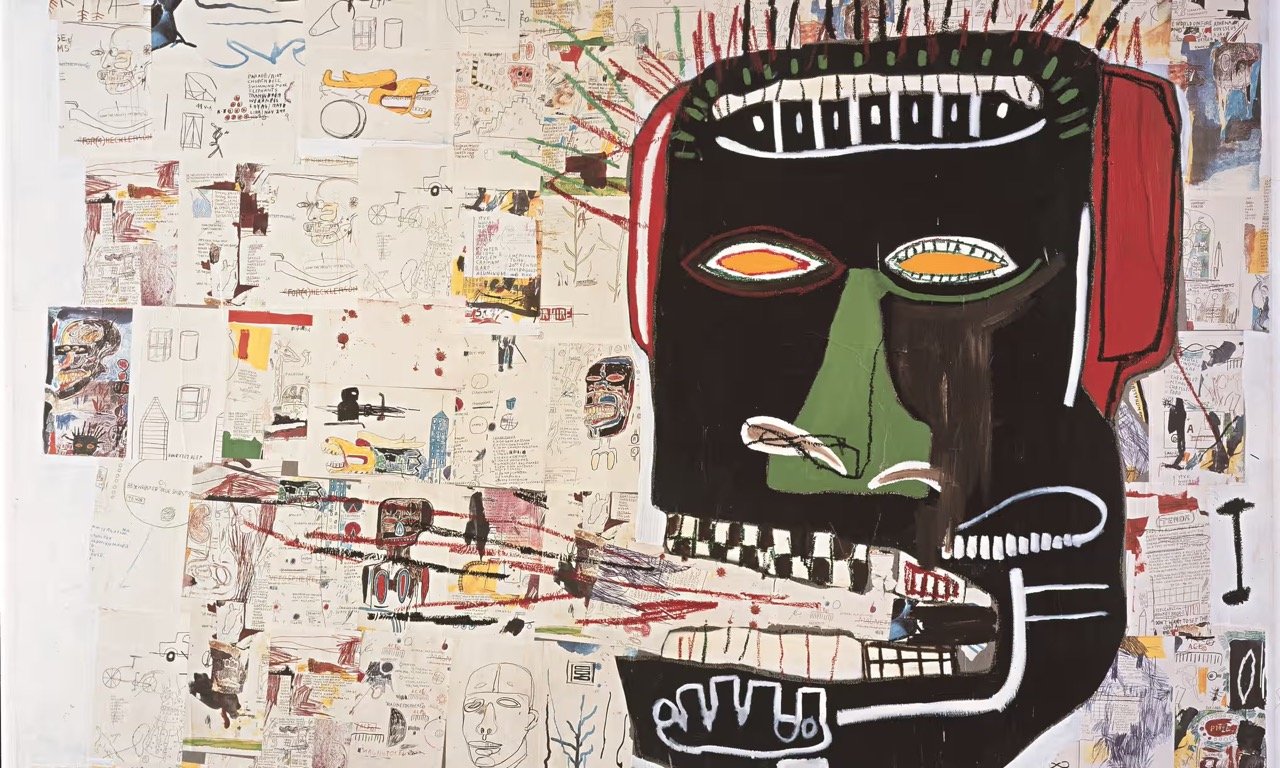

Whether you believe the art market is justifiably priced, there is no doubt that art is a valuable asset. In 2022, late Microsoft co-founder Paul Allen’s collection filled with works from some of the most profound artists of all time fetched $1.5 billion at an auction with New York-based auction house Christie’s. The collection included historic pieces from the art world's who's who, ranging from a $117 million Van Gogh painting titled “Verger avec cyprès” to a “cheaper” piece from abstract artist Jasper Johns, which sold for $55 million. Another example is when Italian designers Alberto and Stefania Sabbadini paid $253,000 in 1996 for Jean-Michel Basquiat's "Equals Pi" and then sold it in recent years for more than $15 million. The Sabbadinis are not the only couple who watched their investments into fine art grow exponentially. Robert and Ethel Scull in 1973 sold 50 works in their collection. Among these works included a Cy Twombly painting purchased for $750, which later sold for $40,000, and a Jasper Johns painting originally bought for $10,000, which also sold at the auction for $240,000.

These numbers are mind-boggling, and raise many questions such as “Is it really worth that much?” The answer to this question is yes, it is. Investments in art can see extreme returns. About three years back a friend of mine purchased a work on canvas from Brooklyn-based artist Robert Nava for around $50,000. In May of 2023, a Nava painting of similar dimensions sold at auction for $355,600. The return on investment for this painting? 600%, or about 92% year over year. An investment into the S&P of the same amount based on historical calculations, today would be worth $67,088.81. This investment in comparison grew 34.18% total, and 10.3% year over year. The best part, it’s been on his apartment wall the whole time.

These returns are not true all the time, but art continuously proves itself as a viable investment. Art is even being recognized by institutional wealth managers as something that should be a part of an overall wealth management strategy. Researchers at Deloitte found the percentage of wealth managers who believe in art as a viable investment grew by 23 percentage points from 2014 to 2015, from 55% to 78%. Art is being accepted by major institutions as an important asset class, and this is due in part to the uncertainty traditional investments have.

Simply put, the stock market is very volatile. A slew of factors influence how stock prices behave, from inflation to political influences to social influences. This year alone, Dish Network has seen its stock drop 54%, and this is just one of many examples. The stock market is volatile, but the art market appears to be rather stable. CitiBank conducted a report in 2022 that found that blue-chip art has little to no correlation to other asset classes.

Contemporary art even does well in times of high inflation, appreciating 13.8% over the last 26 years in comparison to the S&P 500 only appreciating 10.2%. The stock market is also very reactionary, and this is greatly influenced by the flow of information according to Investopedia. Art, on the contrary, is less affected by the traditional flow of information. It does not react to world news and typically holds itself as a store of value.

Despite swings in the market, art has held strong. Over the last 26 years, contemporary art has outperformed the S&P 500 by 131%. This is a staggering difference, and hearing this discrepancy should very well signal to investors that art as an asset class should be looked into more thoroughly. Art proves itself to be resilient through market cycles.

One of the long-standing questions with investing in art: Can average people really afford this? Historically, even someone making $700,000 a year couldn’t afford prominent artworks at auction. Then in 2017, Scott Lynn founded Masterworks, a company seeking to make the art world investable. Masterworks allows users to invest in artworks as one would do with the traditional stock market, doing so by making these multi-million dollar works accessible through shares of the work itself. According to its website, Masterworks has over $880 million in assets under management with 344 works purchased. Investors can purchase a stake in an art piece, and when it is sold in 3-10 years at auction, see their returns be actualized.

One example of this can be seen in the sale of an iconic work by Albert Oehlen netting investors a 33.8% internal rate of return. To specify how this worked, Masterworks offered investors the opportunity to purchase shares of the painting in 2021 for $20 per share. When the painting sold for $1 million more a year later, investors celebrated a very strong return.

They are not the only ones making art easier to invest into. In 2020, the ARTEX Stock Exchange was founded, becoming the world’s first art stock exchange platform that is regulated. This platform allows for individuals to easily access art shares and trade them like traditional stocks. As companies like these grow, art becomes more accessible to invest for all, not just the wealthiest of the world.

Is the stock market reliable? Of course, it has been shown for decades to be a smart place for people to allocate their money to receive decent returns. However, stocks aren’t as visually striking as art is. Art as an asset class allows investors to see their money on their wall, creating not only value over time, but being a source of social curiosity as well as beauty. Art adds warmth to a home and can evoke an array of emotions in viewers. Couple this with it being able to make me money, and well, sign me up. I'll take two Picassos, please.